It’s Not Just Bad Apples: Wall Street Sentiment on AAPL Stock Falls to Multi-Year Lows, so Should You Sell Shares Here?

/Apple%20Inc%20phone%20and%20data-by%20Anderson%20Reis%20via%20Shutterstock.jpg)

Apple (AAPL) was the best stock to buy and hold for the long run, with Warren Buffett having over half his portfolio allocated to it at one point. Analysts would rarely turn bearish on it, as doing so would mean losing out in the long run.

However, that's precisely what is happening. The market may be growing beyond Apple, with analysts concerned about Apple's lack of competitiveness when it comes to artificial intelligence (AI).

Just 55% of analysts tag it a "Buy." For a “Magnificent Seven” company, this is a terrible sign. Investors are increasingly seeing Apple as a stale company with an innovation problem.

Analysts Downgrade Apple

There has been a cascade of analyst downgrades, with a pair of analysts cutting their ratings over concerns that the company isn't taking AI seriously enough.

D.A. Davidson cut its price target to "Neutral" from a "Buy" rating. Phillip Securities downgraded it to "Reduce" from "Neutral."

This came shortly after Apple's iPhone 17 reveal, with one analyst noting that the new products “left us uninspired.”

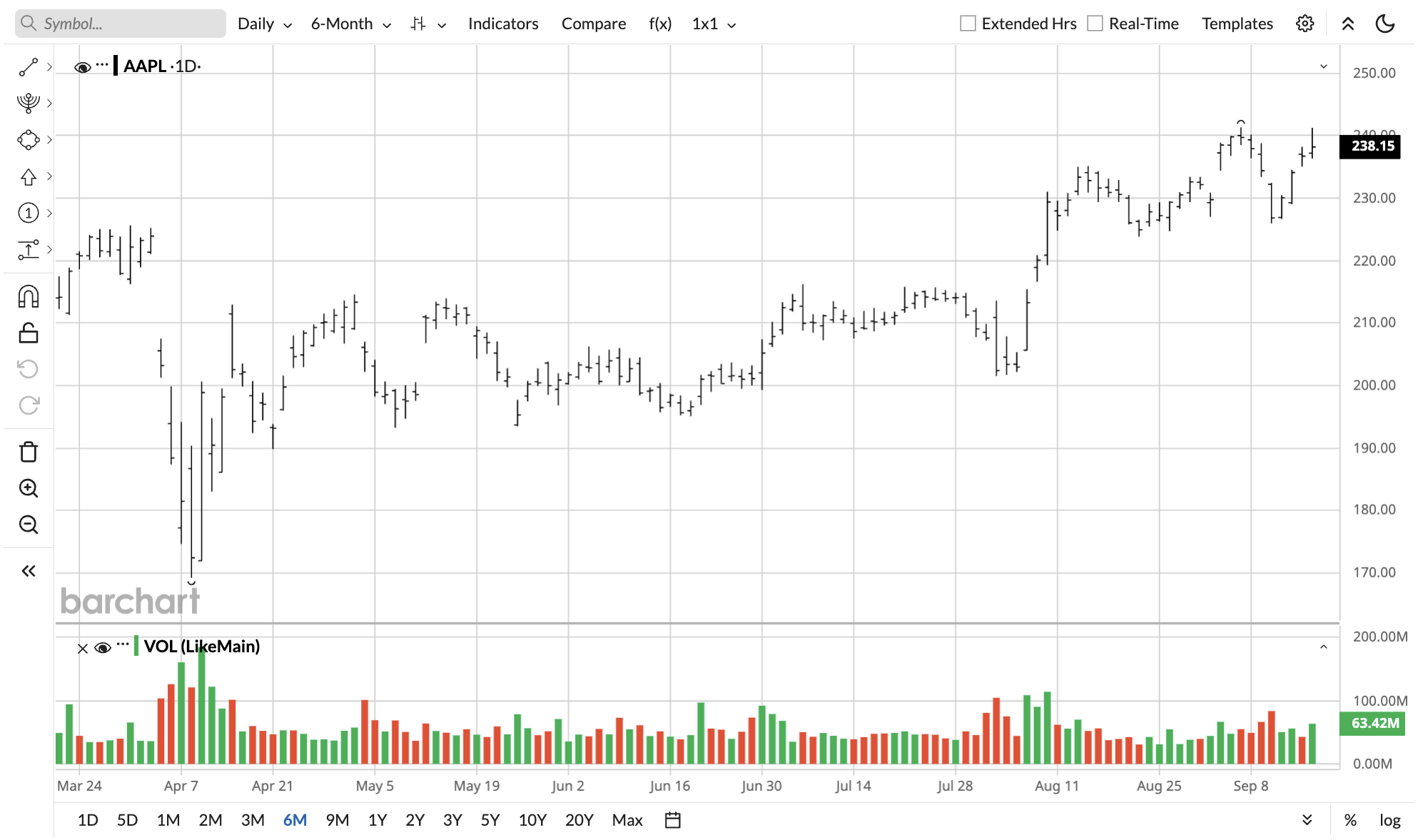

The mean price target has dwindled to $241.58, which is barely higher than AAPL's current price of $238.15 as of this writing.

Of the 38 analysts, the bullish side is only ahead by two ratings. 20 tag AAPL stock as a "Strong Buy" or a "Moderate Buy," with the rest rating it a "Hold" or lower.

Neglecting AI Can Cost Apple Dearly

Apple's recent iPhone 17 launch event barely mentioned artificial intelligence. It seems to be playing the AI game too safely, and doing so is also a gamble. Others are racing ahead when it comes to AI and are reaping the benefits. Almost every other Mag 7 company, except for Tesla (TSLA), trounces Apple's growth.

It's very telling that users are looking for alternatives, as Google's (GOOG) (GOOGL) Gemini currently ranks as the top app on Apple's own App Store.

An even better way to get the most out of Gemini is by using an Android phone. This will break Apple's entire flywheel if iOS fails to retain users due to a lack of AI features.

Revenue grew 9.6% in Q2 2025, with a similar 9.3% net income increase. Don't get me wrong: these are great numbers, but they pale in comparison to how fast most cutting-edge tech companies are growing today.

Time to Buy or Sell AAPL Stock?

You pay 32 times forward earnings for AAPL stock today. You also pay 8.5 times forward sales. Analysts expect Apple to grow its revenue by around 5-6% each year going forward, with EPS growth hovering in the high single digits.

In comparison, you pay 39 times forward earnings for a company like Nvidia (NVDA). Nvidia grows its revenue over 10 times faster, and EPS is expected to grow around 5 times faster this year.

Apple has been a lasting blue chip and is quite a safe investment. This deserves a premium, but usually not to this extent, and especially not if it's a tech company that seems to have surrendered its AI ambitions.

Remember, Apple came out with one of the first popular AI conversational assistants in 2011: Siri. Things would look a lot different if Apple had kept on pursuing leadership in the AI space.

I would not buy AAPL stock today, but I wouldn't sell my stake entirely. I'd copy Buffett and sell 60-70%. The company still has time to catch up, though the outlook is grim.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.